Sep 29, 2014

in Mutual Funds

We wonder how many investors possibly understand this extremely simple concept. ETFs do NOT HAVE SHARE CLASSES. Mutual funds have share classes for one reason -- to make more fees for the fund company and brokers.

Below is image highlighting the tradeoff in 2 classes of Janus Unconstrained Bond Fund. Bill Gross the manager just manages one large sum and probably doesn't even look to see which share class has the assets --- it doesn't matter to him, he just buys and sells bonds for the aggregate portfolio. But for investors, the fund is divided into segments.

In this case, you could go with Class A shares which have a 4.75% sales front load fee and an expense ratio of 1.08%. Or you could buy Class C shares and pay no front load --- but pay a 1.83% expense ratio and owe 1.00% as a back load --- when you sell it you are stuck an extra 1%.

Now think about it from a brokers perspective. Which do you want your clients to buy? If you have incentives to push load funds, perhaps you stick your clients with the A shares because your firm gets that juicy 4.75% upfront fee. However, note the 12b1 fees. Class A has a 0.25% 12b1 and Class C has a 1.00% 12b1 fee. What is a 12b1 fee? It's an ongoing kickback from the fund company to any outside broker who puts their clients in that fund. So for example, you are a broker that works for a company that is not Janus --- Janus will pay you an ongoing fee forever to keep your clients in it. That fee is IN ADDITION TO whatever management fee you charge your clients. The great part about 12b1's is that they are hidden!

Do ETFs have 12b1 fees? Nope. So doesn't that make you wonder, why would a broker ever put a client in an ETF when they can earn 1.00% forever from Janus? The problem with those silly ETFs is that how do you make any money off them? Exactly. This is the very essence of the problem. Yet ETF assets continue to grow and grow and grow. How is that? Because many investment advisors are content with simply charging a straightforward fee and do the right thing and don't buy fees with loads and 12b1's. Fees like 12b1 fees have been totally outlawed in other countries as too much of a conflict of interest. But not in the USA.

That all said, Janus C shares might be a RELATIVE bargain compared to many hedge funds. Happy investing.

Jul 02, 2014

in Volatility

When you study finance, you have to first learn the basic fundamentals of portfolio theory. When you eventually move to real life, you quickly realize how theory is only a starting point. Nevertheless, it is useful to know the "book theory" because it provides something of a very basic framework. That said, in the words of the great investor Mike Tyson "Everyone has a plan 'till they get punched in the mouth." First, here is the look of a list of ETFs that climb up the risk curve.

Note that this was posted on this given date covering this very specific time period. Using those precise assumptions, the book theory held up nearly perfectly -- a line going from lower left to upper right --- more return for more risk. But you have to remember --- that was using some very careful selections. Here is an example of a different time period where equity investors were punched in the mouth, Tyson-style:

The point is that the volatile ETFs that are towards the right side of the chart will be the ones to have large intermediate-term drawdowns and large intermediate-term returns. The ETFs on the left side will have low drawdowns and low returns. These are very generic ETFs. Where this gets much more interesting is when you use other ETFs that track more interesting indices.

Watch our backtesting videos.

Dec 01, 2012

in Ratio

Quick mini-analysis of an ETF we are long in our Allocations Board models (EPP).

Here is a summary of the rationale:

We went long EPP on an Allocations Board portfolio during a small pullback in late August. (members can see allocation board for details). Why EPP and why then?

First, EPP is a regional ETF covering developed markets in the Pacific ex-Japan region. This means companies based in Australia, Hong Kong & to a lesser extent Singapore and New Zealand. Note that none of these are considered emerging markets --- though all are clearly closely tied to the growth of Eastern Asia, which in turn are all emerging Markets (ex-Japan).

EPP began by performing well on a relative strength basis during the summer of 2012 vs various lists we keep on constant monitor.

EPP is very volatile -- so we wanted to expose the model to strong relative strength -- but also be sure to plan ahead in case things went adversely against us. This can be a tricky situation because you absolutely must give yourself a chance to participate in the uptrend by giving it some room in the short-run ---- but we wanted also to have a plan in place to avoid large portfolio drawdowns. Below is a snapshot using the Ratio MA module to manage the individual position. Also included are some pullbacks which are normal for a volatile security like this. These would be buying opportunities within a perceived uptrend. This is not meant to be how anyone else should choose to manage a position. This is just a snapshot of how we were thinking about it.

The exact parameter settings should not be the focus here. Investing is not a pure science, in our view. It is much more like a game of poker, partly mathematical and partly behavioral/psychological. Good poker players don't take wild risks with no plan in place if things go adversely. They start out with a plan for each part of the hand and then make adjustments and often have to make some tough decisions as more information is revealed that is adverse to their position. Sometimes they make a mistake and fold the best hand (like a trading whipsaw) --- but over time, good long-term decision-making is what makes a good investor (and a good poker player). PLAN YOUR HAND.

Note that the ETF in discussion here (EPP) was not chosen in the first place because of this ratio MA analysis -- that is just a second more detailed view of how we planned to manage the position. EPP was instead originally chosen because we like what the ETF represents on a fundamental basis (companies based in Australia, Hong Kong & Singapore) AND it also was showing strong signs of a new uptrend beginning (this is what good relative strength analysis does -- it locates particular strength in the market that over time suggests continuation rather than reversal).

Oct 15, 2012

in Volatility

Risk-parity is a weighting methodology. Given a set of securities in a portfolio, risk-parity overweights lower-than-average volatility securities and underweights higher-than-average volatility securities.

Q. How does it work?

One of the most commonly accepted ways is to start with equal-weight positions and then make adjustments based on the relative volatilities.

Because volatility always embeds a specific time-period assumption, you must specify the time-period (or lookback) you want to use. There is no universal definition on what time-period is correct.

If you choose a shorter lookback period, then your portfolio will adjust more quickly to major changes in volatility. If you choose a longer lookback, then you will have less trading and less whipsaw losses when corrections end quickly and recover.

(for what its worth, we have observed that some index providers use 12-months for the lookback time period and then chooose to rebalance quarterly. But keep in mind that given two different analysts using different assumptions, you will get two different results for the same list of securities within a risk-parity portfolio. As noted, there is no single 'answer').

Q. What is the purpose of all of this?

To us, one of the more interesting problems facing investors are questions having to do with how we weight securities that are in totally different asset classes. Some securities mature at par (bonds) and some are perpetual (stocks) --- some represent paper securities with high yields (preferred stocks) and some can be physical securities that have zero yield (Gold). So long as something is actively traded on an exchange with accurate TOTAL RETURN pricing, risk-parity principles can offer an idea on a weighting methodology that uses the same metric across all of these disparate secruities.

Q. Does risk-parity give an optimal weight?

No. There is no way to calculate an optimal weight for the forward period so risk-parity looks at recent experience and applies that to the future period.

Problem -- if short or intermediate bonds are used, the risk-parity methodology will always very heavily weight bonds (especially lower duration bonds). This is because bonds that have fixed maturity dates will (nearly) always be far less volatile than securities that are perpetual (like stocks). Clearly, low-duration bonds don't have much return potential either so if you were to follow risk-parity, you would end up heavily overweighting bonds relative to something like a 60-40 mix.

Q. Is risk-parity better understood as a concept or as a formula?

While risk-parity sounds quite pleasing, our opinion is that like just about everything in investing, understanding the concept behind it is more important than solving a formula. This goes back to the very basics of investing: given similar return expectations you should choose to more heavily weight the lower-volatility security. This does NOT mean that high-volatility securities are not investable -- it just means that you must have higher return expectations for the high-volatile assets. If your return expectations are indeed higher, then it will make sense to overweight the higher-volatile asset.

Risk-parity will tend to do very well in any period with significant bear markets for an obvious reason, its focus on bonds. Risk-parity will generally (but not always) underperform in up markets for the same reason.

In our view, the point of backtests -- including risk-parity backtesting -- should not be to determine a formulaic 'answer' --- the point is to let backtesting help you digest large amounts of data and be part of the research process that helps you come to a conclusion about what is the right portfolio - in that situation - for that client - at that time.

There are many ways to use volatility to help think about your portfolio exposures and it takes judgment at the end of the day. Given that risk-parity does nothing to adjust for differing return expectations across securities, it should be viewed as simply another tool, not an entire strategy in itself.

-----------------------

Example:

To understand the risk-parity calculation, it is important to realize how a risk-parity portfolio differs from an equal-weight version of a portfolio with the same holdings.

This example will use ETFs from 2 different asset classes: Gold (GLD) and Real Estate Investment Trusts (REITs). Think of it as a way you might want to research how to weight your 'alternatives' allocation. For round numbers, assume alternatives make up 10% of your total portfolio and you want to research how risk-parity handled the past 7 years.

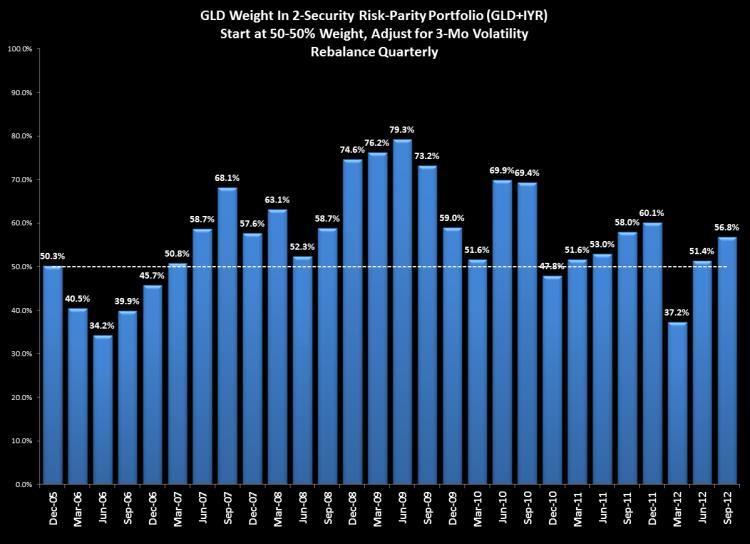

Below would be the weight of GLD using 3-month risk-parity for the period:

Note that in 2006, the risk-parity methodology had Gold as an underweight vs real estate. At the time, real estate was in the tail-end of a major bull market. As 2007 began, the weightings equalized (signalling equal volatility) and then REITs went into a major bear market and Gold came to be about 75% of the mix for about a year. Since the end of 2010, the weightings have been on average near equal. Note also that over that same time, the returns of REITs and Gold have been about the same.

The risk-parity module is embedded within the core-satellite application. Here is a screenshot:

Aug 31, 2012

in Ratio

Credit markets don't appear to be too concerned about recession in United States. Junk Bonds have been outperforming Treasury Bonds lately.