Using RS Composite to avoid parameter value misfortune

Jan 02, 2025

in RS Composite

With any parameter based model the risk always exists that a single particular value will underperform in the future, even though it performed well in backtests.

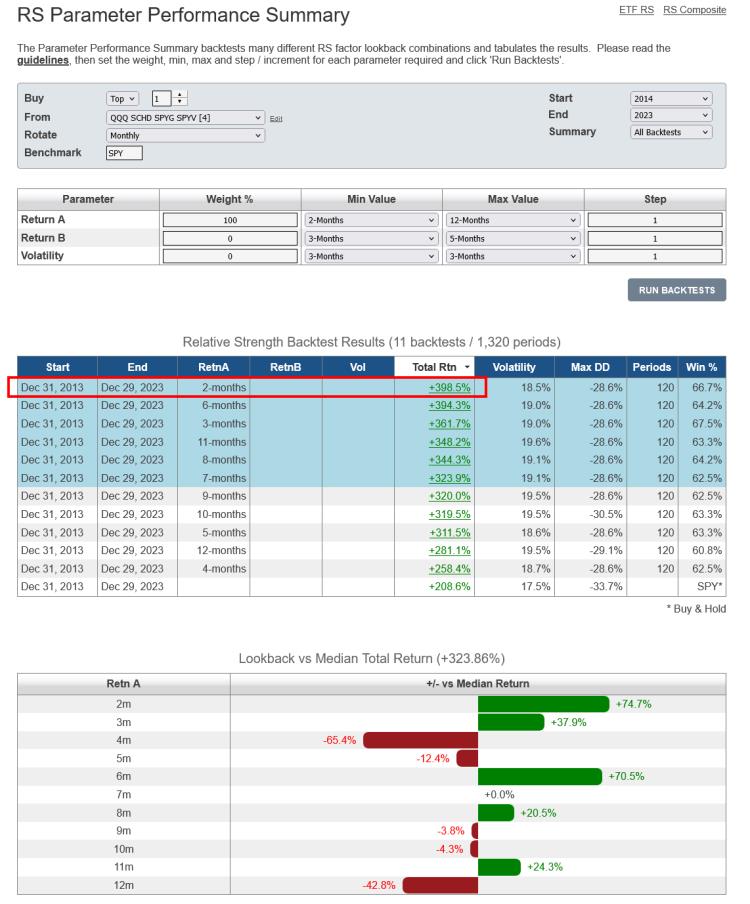

Below is the Parameter Summary of a Relative Strength model that invests in the strongest (i.e. top 1) security from a list of 4 U.S. equity ETFs (QQQ, SCHD, SPYG and SPYV). For the 10-years through 2023, the highest Total Return was produced by the 2-month lookback length.

click image to view full size version

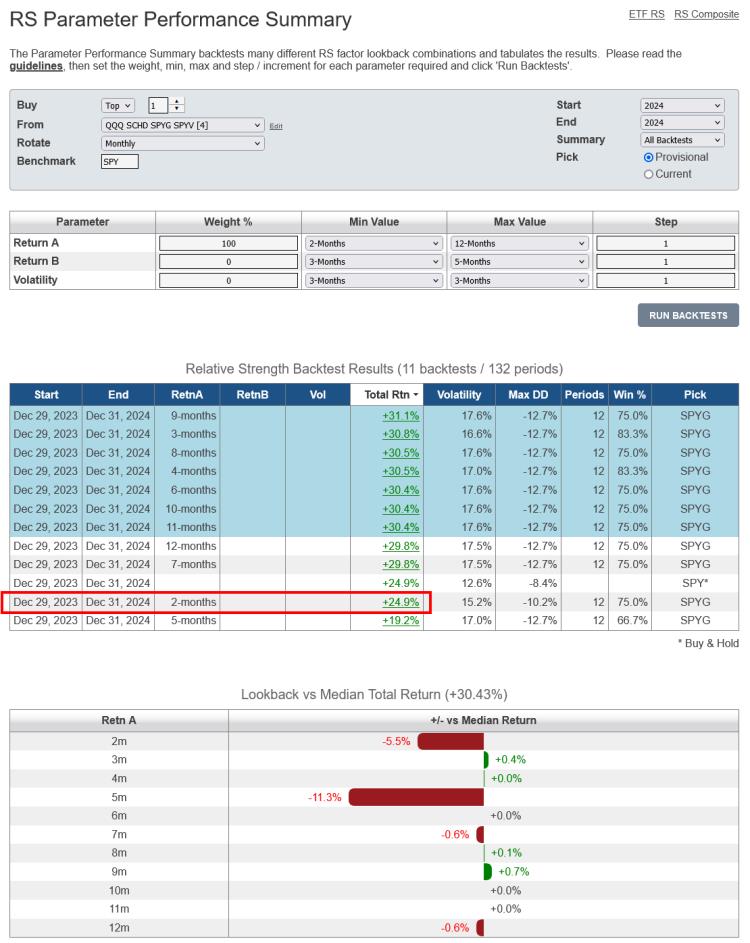

During 2024, however, the 2-month lookback was the second worst performer.

click image to view full size version

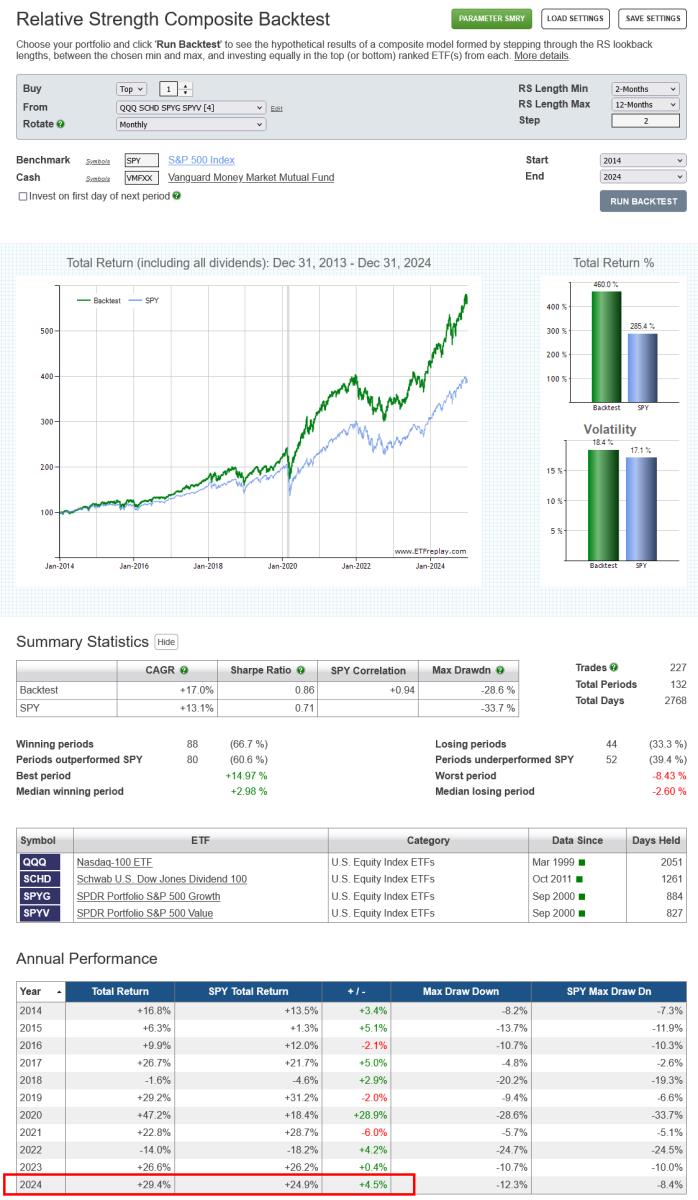

The RS Composite method, which we introduced in early 2023, hedges against this uncertainty by diversifying across a range of parameter values. For example, below is an RS Composite backtest where the minimum lookback length is 2-months, the maximum lookback is 12-months and the step value is 2. This means that, each month, rather than investing is just the top ETF ranked by 2-month returns, the composite backtest will invest 16.67% in each of the:

- top ETF from QQQ, SCHD, SPYG and SPYV ranked by 2-month returns

- top ETF ranked by 4-month returns

- …6-month returns

- …8-month returns

- …10-month returns

- top ETF ranked by 12-month returns

click image to view full size version

As can be seen, whereas the 2-month single lookback strategy was comparatively underwhelming in 2024, the RS Composite model performed rather well.

For more, watch this video: Using Parameter Summaries and Composite Relative Strength

Notes:

- a composite model will always underperform the single best parameter value, but, as demonstrated, it avoids being exclusively in the worst performer.

- Studying the Parameter Performance Summary guidelines is always highly recommended

Follow ETFreplay on