Regime Change 60-40 Allocation Example

Feb 14, 2025

in Regime Change

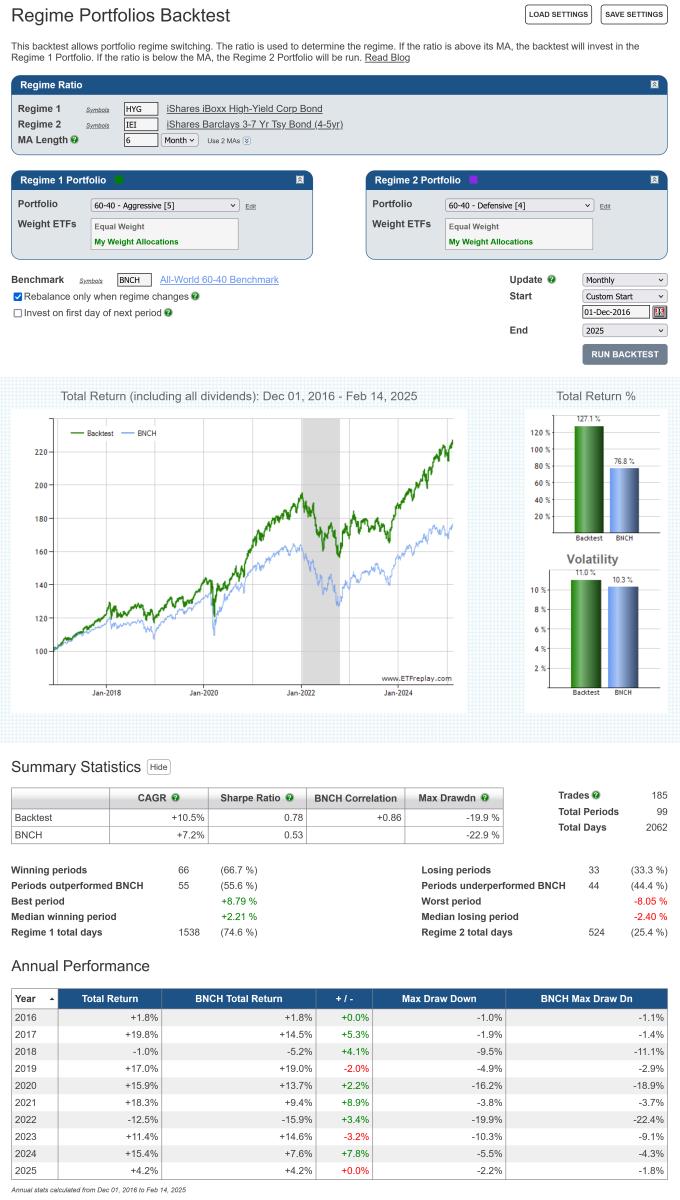

In 2016 we wrote a blog post with an example that employed a simple credit spread style ratio (HYG / IEI) as a regime indicator to switch between aggressive and defensive 60- 40 allocations.

When the High Yield / Treasury ratio was in an up trend (i.e. HYG / IEI was above its 6-month moving average) the backtest invested in the aggressive portfolio, which contained Emerging Markets, Financials, Nasdaq and High Yield ETFs. When the ratio was below its MA, the backtest switched to the defensive 60-40 portfolio that held Treasury Bonds, Utilities, Healthcare and Consumer Staples.

Below is an update of the same Regime Portfolios backtest, starting from the end date of that blog post example; December 1st, 2016.

click chart image to view full size version

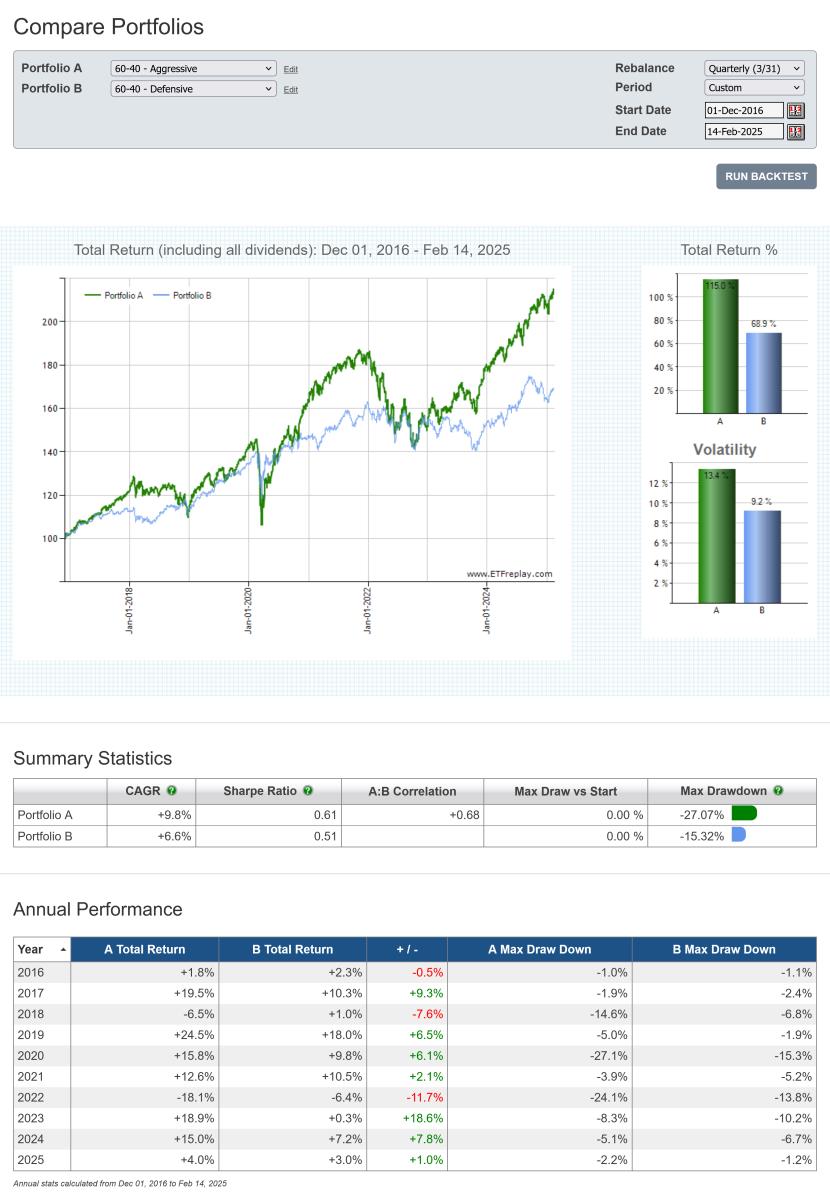

During the 9-year out-of-sample period since the original example, the regime model has been invested in the aggressive portfolio (Risk On) approximately 75% of the time. The performance of both the aggressive and defensive 60-40 portfolios, over the same time period, is displayed below.

click chart image to view full size version

As with the original blog post, this should not be viewed as a strategy to be replicated as is. Rather, its' purpose is simply to illustrate the regime change concept and to provide a starting point for subscribers to further develop with their own ideas.

See:

Regime Portfolios backest

Compare Portfolios backtest

Follow ETFreplay on