Layering 2 ETF Backtest Strategies For Enhancing Return

Dec 16, 2019

in Mean Reversion, Relative Strength, Video

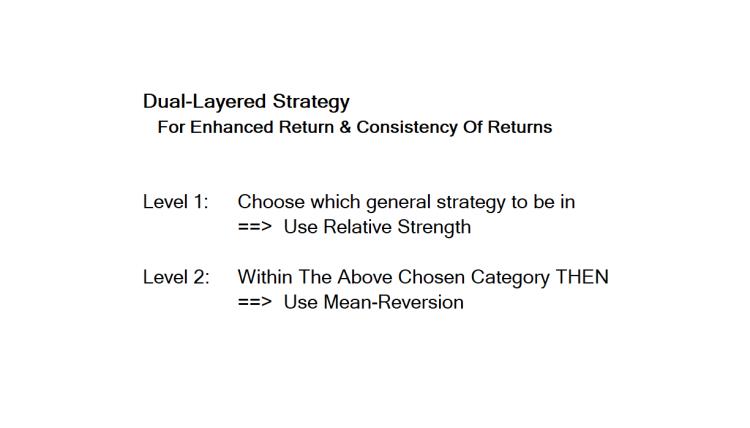

Layering 2 strategies on top of each other for better return -- and importantly this can improve the consistency on a year-to-year basis. The mean reversion strategies tend to add more return when things are volatile -- but less relative to the benchmark when the market is rising on low volatility. That said, low volatility uptrends are often an excellent environment for absolute gains anyway and you will naturally participate in such a market because mean-reversion has zero market timing associated with it. That is, sometimes you will just track rather than outperform a low-volatility uptrend.... and that is a good thing.

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen

Follow ETFreplay on