Dual Position Backtesting: diversify across rotation days

Apr 22, 2021

in Relative Strength, Sequential RS

We have added two new rotation options to the Portfolio Relative Strength and Sequential Relative Strength Backtests:

- Monthly (Dual Position)

- Weekly (Dual Position)

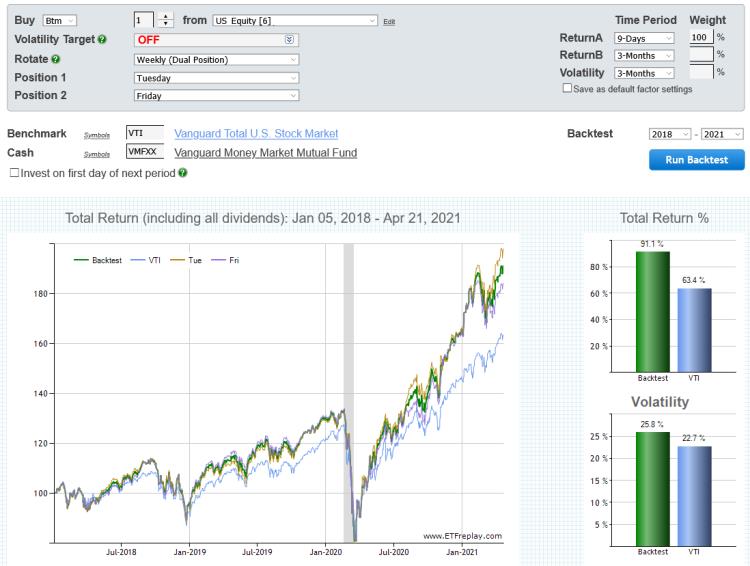

Choosing one of these options allows you to diversify across two rotation days. For example, select Weekly (Dual Position) and set Position 1 to Tuesday and Position 2 to Friday. In the chart below the yellow line shows the performance from rotating every Tuesday, the purple line is the Friday rotation, and the green line shows the combined equity curve.

click image to view full size version

Diversifying across two rotation days hedges against going all-in on what could turn out to be the worst performing rotation day in future. Similarly, though a particular day may have historically performed best, it is not guaranteed to always outperform. Employing two different rotation days guards against that risk and in doing so, can provide a more realistic assessment of a strategy’s performance.

Follow ETFreplay on