Sep 02, 2022

in Dashboards

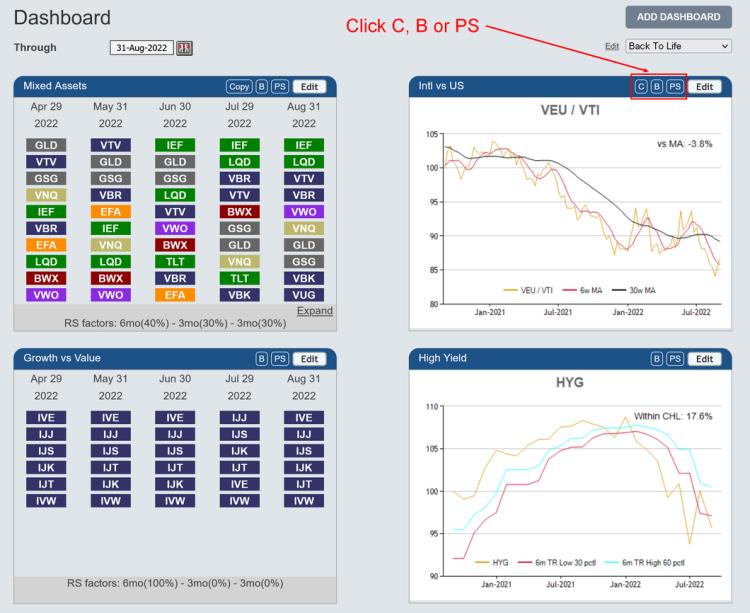

We have added the following new options to dashboard window headers to make it easier and quicker to access related tools:

- C - click to open a new browser tab containing the Charts page that’s auto populated with both securities from the dashboard window

C appears above Ratio MA chart and TRD chart

- B - click to open a new browser tab with the relevant Backtest auto-populated with the securities / portfolio and parameters from the dashboard window

B appears above Ratio MA chart, MA chart, CHL chart, TRD chart and Ranks

- PS - click to open a new browser tab containing the Parameter Performance Summary that's auto-populated with the securities / portfolio and parameters from the dashboard window.

(note: Parameter Performance Summaries are available to annual subscribers, both regular and pro)

PS appears above Ratio MA chart, MA chart, CHL chart, TRD chart and Ranks.

click image to view full size version

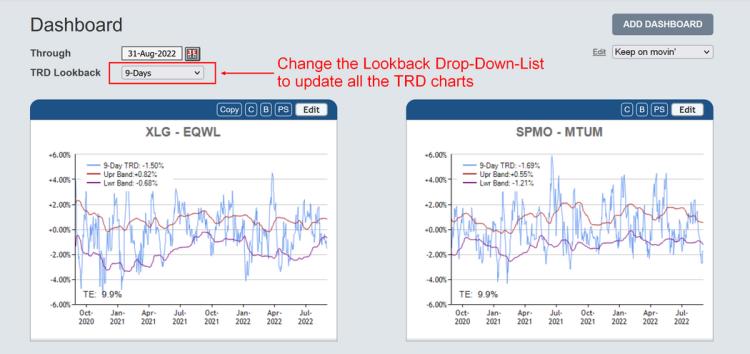

In addition, if all windows on a dashboard are TRD charts, a TRD Lookback drop-down-list now appears at the top of the page, beneath the ‘through’ date selector. This drop-down-list controls all the TRD charts on the dashboard, making it very easy to switch between lookback lengths.

By default it is set to 'Saved Value'; each of the TRD charts displays its own saved lookback length. If the drop-down-list is changed to 9-day, for example, then all the TRD charts on the dashboard will be recalculated and display a 9-day TRD. etc.

click image to view full size version

Aug 23, 2022

in Regime Change, Ratio

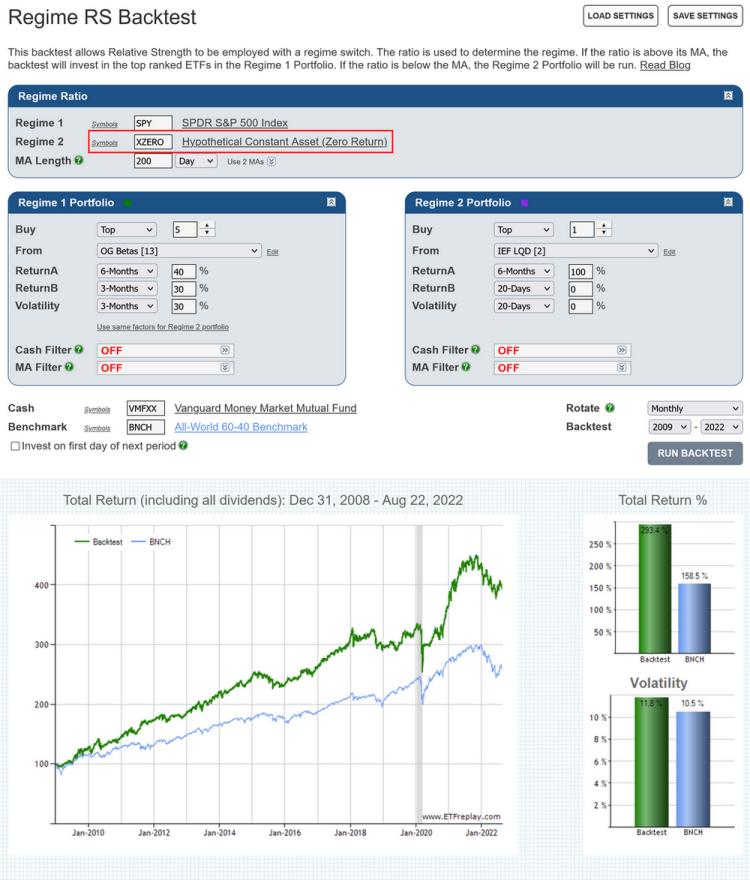

A question that we receive with some regularity is "can I run a backtest that changes strategy based on whether SPY is above or below its 200-day Moving Average?"

The answer is yes. We have a group of backtests that switch between strategies depending on the prevailing regime. These regime backtests build up on the logic of the Ratio MA backtest and come in 2 varieties:

With these two backtests, when the ratio is above its MA the backtest runs the Regime 1 portfolio / RS strategy (i.e. Risk On). Conversely, when the ratio is below its MA, the Regime 2 (Risk Off) portfolio is chosen.

If, rather than using a ratio, you want to switch strategy based on whether or not SPY alone is above / below its 200-day MA, then you can use XZERO as the Regime 2 security.

XZERO is simply a zero return index (i.e. it's a constant), so an MA of the ratio SPY / XZERO is the same as a moving average of SPY itself (see the Parameter Summary comparison at the bottom of this post).

Regime RS backtest that uses the SPY 200-day MA to determine the regime

Note: Moving Averages on ETFreplay are calculated using Total Return. i.e. the calculation does not just use closing prices but also accounts for the receipt and reinvestment of any dividends and distributions. The MA is then compared to the Total Return value of the ETF, so that it's like-vs-like; everything is Total Return, not just price.

See:

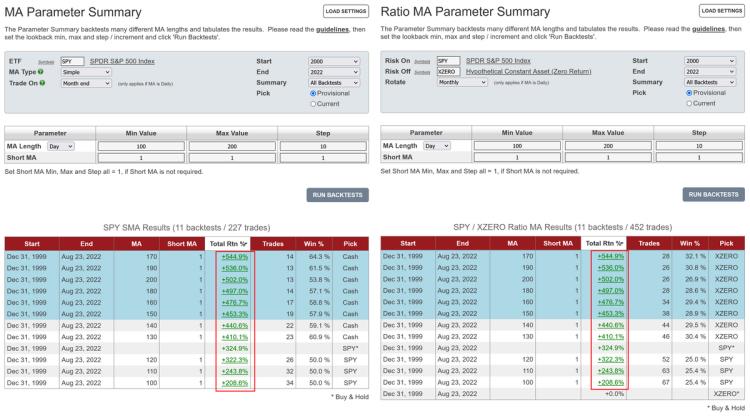

SPY MA Parameter Performance Summary on the left. SPY / XZERO Ratio MA Parameter Summary on the right. The backtest returns are the same.

Jul 05, 2022

in Backtest, Dashboards, Tracking Error

We have added some new functionality to the Core-Satellite backtest, Tracking Error tool and Dashboard.

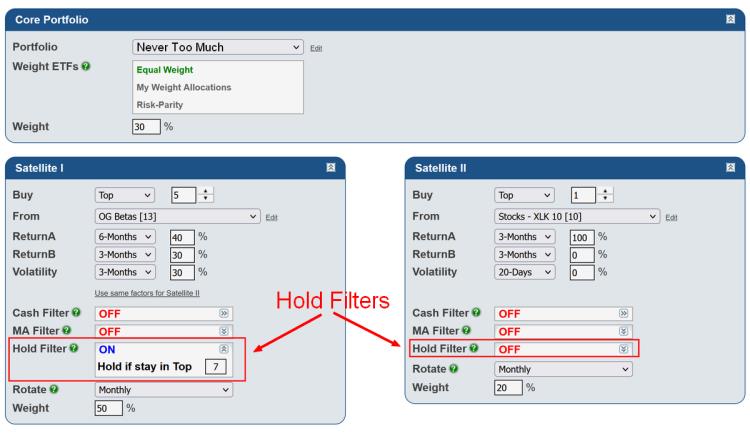

Core-Satellite

The Core-Satellite backtest has an updated look and the Hold Filter, which we recently added to the Portfolio RS and RS - Combine Portfolios, can now be applied to either (or both) of the satellites.

click image to view full size version

The appearance of the other parallel relative strength backtests, the sequential RS and various regime backtests has been similarly updated.

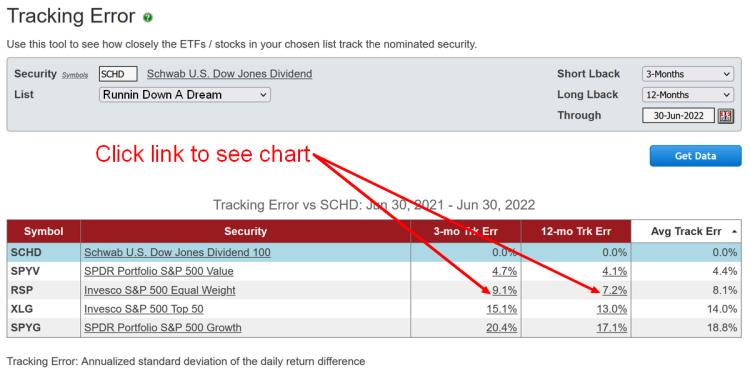

Tracking Error tool

The tracking error values now link through to the ETF charts page, which will automatically load the two securities over the specified duration and display their performance.

click image to view full size version

Dashboard

We recently added a new Summary window option that displays the 1-Day, Year-To-Date, 2021 and 2020 Total Return of each security in your chosen list.

click image to view full size version

Apr 10, 2022

in TRD Total Return Diff, Video, Tracking Error

Instructional video on how to use Tracking Error to improve consistency in ETF backtesting. #STUDY

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen. Use the settings icon to change to 1080 quality if it seems at all blurry

Apr 05, 2022

in Backtest, Relative Strength

We have added a Hold Filter option to the Portfolio Relative Strength and RS - Combine Portfolios backtests.

When the Hold Filter is turned on, the ETFs will be held as long as they remain ranked in the top (or bottom) Y.

i.e. If you choose a Buy Top of 2 and a Hold rank of 4, then the backtest will invest in 2 ETFs, but will only rotate out of an ETF when it drops below the top 4.

Using the Hold Filter makes a model less reactive and as a consequence it reduces trade activity. By not switching each and every time a security moves in and out of the top X, it can also result in fewer whipsaws. However, the higher the hold rank number is, the less responsive to changes the model will be, so a balance must be struck.

click image to view full size version

Note: the hold rank must be greater than the buy top / bottom number and be less than the number of securities in the chosen portfolio(s).