May 24, 2021

in Video, Sequential RS

Reviewing some recent actual trading from the lens of some of our backtesting applications. #STUDY

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen. Use the settings icon to change to 1080 quality if it seems at all blurry

Apr 22, 2021

in Relative Strength, Sequential RS

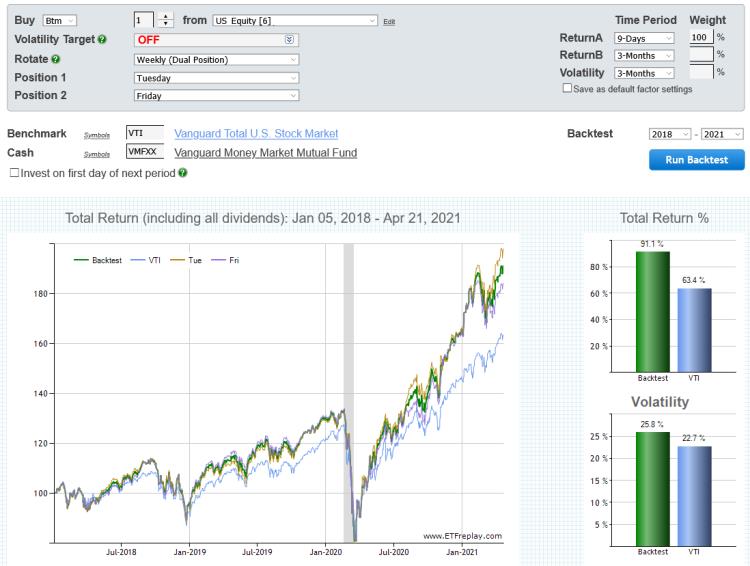

We have added two new rotation options to the Portfolio Relative Strength and Sequential Relative Strength Backtests:

- Monthly (Dual Position)

- Weekly (Dual Position)

Choosing one of these options allows you to diversify across two rotation days. For example, select Weekly (Dual Position) and set Position 1 to Tuesday and Position 2 to Friday. In the chart below the yellow line shows the performance from rotating every Tuesday, the purple line is the Friday rotation, and the green line shows the combined equity curve.

click image to view full size version

Diversifying across two rotation days hedges against going all-in on what could turn out to be the worst performing rotation day in future. Similarly, though a particular day may have historically performed best, it is not guaranteed to always outperform. Employing two different rotation days guards against that risk and in doing so, can provide a more realistic assessment of a strategy’s performance.

Feb 15, 2021

in Backtest, Mean Reversion, Video, Sequential RS

Note: during the launch of our new application called Sequential Relative Strength, we are allowing all accounts to create portfolios using individual stocks. This app module is able to expand on the core Portfolio Relative Strength and add a 2nd stage to help improve entry points.

Reviewing some recent actual trading from the lens of some of our backtesting applications. This has been a very good market environment for ETF rotation. #STUDY

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen. Use the settings icon to change to 1080 quality if it seems at all blurry

Jan 06, 2021

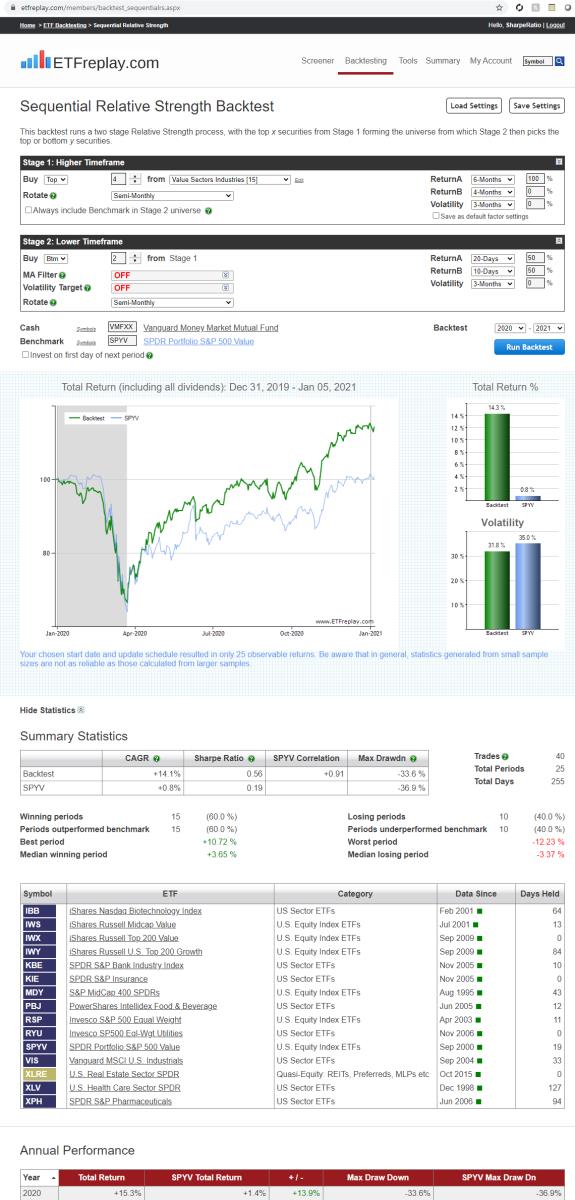

in Sequential RS, Sectors

Relative strength is for segments of the market -- it is not for Growth Stocks or Tech ETFs only, it works for all sorts of things. Below are some value ETF ideas. We have found mixing something like Growth or Value with CORE etfs as well will keep it more mainstream. Up to the user to decide how much deviation from the market indexes they are comfortable with -- below is a starter idea. Note that while many may not equate IBB with value, its simply a fact that the large biotech stocks that are in IBB are also in the value indexes and therefore its more of a 'biotech-pharma' value ETF.

Dec 14, 2020

in Screener, Sequential RS

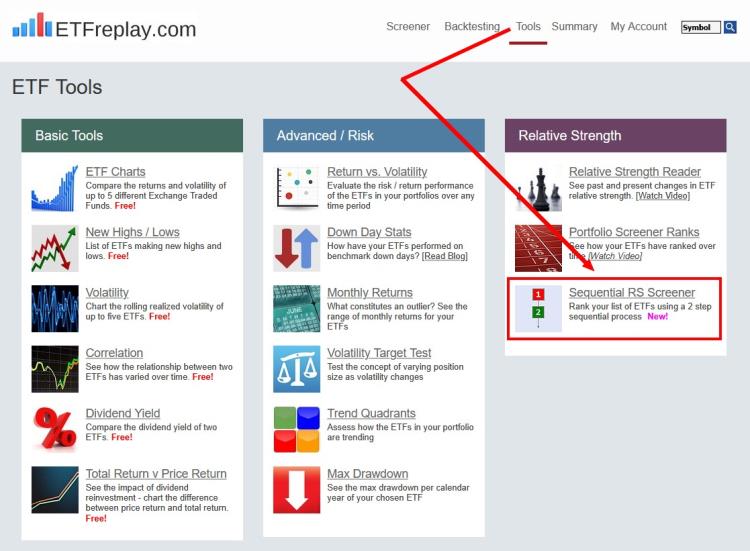

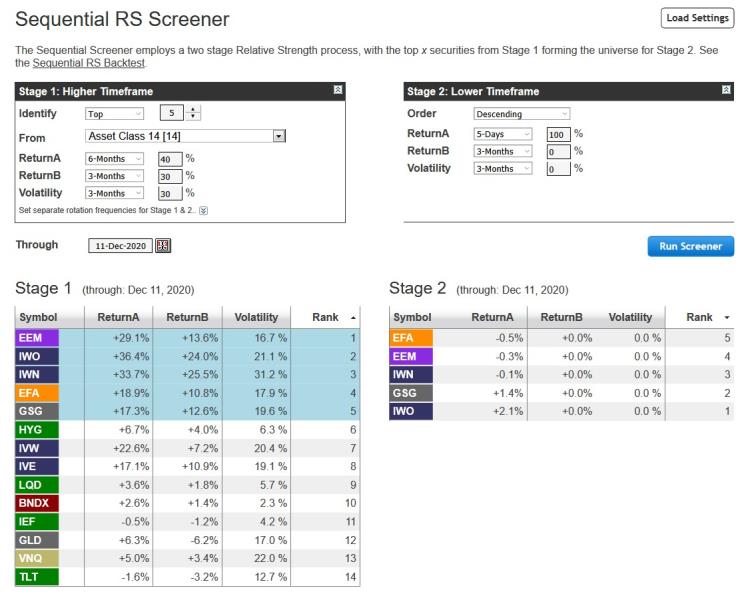

We have added a new tool for subscribers, the Sequential Screener, to compliment the Sequential Relative Strength backtest.

Sequential Relative Strength seeks to identify short-term weakness within a strong longer-term up trend by employing a two stage process. The Sequential Screener displays the rankings and composition of both the first and second stages on any trading date. The side-by-side layout makes it much easier to assess the current situation than the regular screener and can be helpful in anticipating changes in the run up to a rotation.